Potential tax relief on your business acquisitions

The Annual Investment Allowance (AIA) is a type of capital tax allowance that offers 100% tax relief on qualifying capital expenditure in the year of purchase.

Since its introduction in 2008 there have been several changes in the allowance, ranging from £25,000.00 to £500,000 as the maximum potential tax relief. Such volatile changes have not provided long term reassurances for investment; hence the AIA is not yet a widely known benefit.

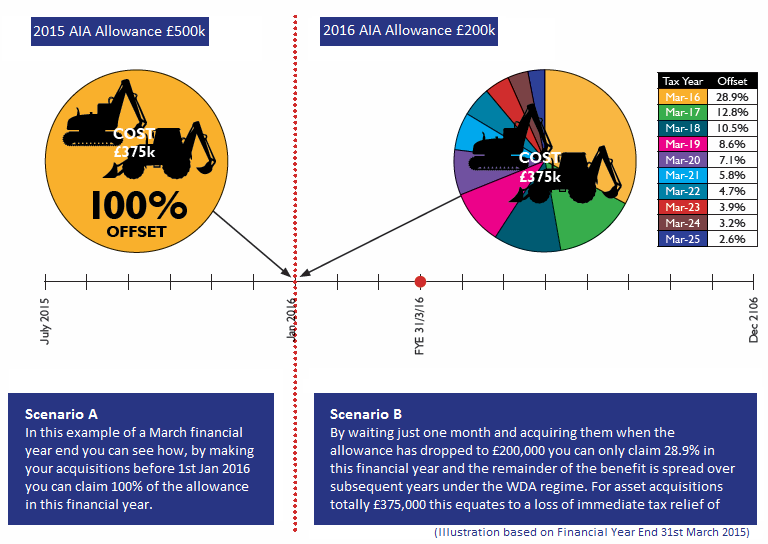

However in the 2015 Summer Budget the Chancellor announced his plans to support growth and investment for Britain’s SME’s and declared that the AIA would be set at £200,000 every year from January 2016. Great news for a stable suture for planning investments in your business assets but if you are eligible for the benefit of up to £500,000, the clock is ticking!

How does the AIA work?

Currently the first £500,000 of expenditure on business assets (e.g. plant and commercial vehicles) per year is 100% allowable against taxable profits of a business deductible in the year that you buy them. This accelerates the tax relief rather than reducing the writing down allowances (WDA) normally applied over several years.

This allowance will reduce to £200,000 from January 2016 but the Chancellor indicate hid desire for this to be fixed year on year to help SME’S plan and invest for growth.

Any expenditure on business assets over the AIA limit would be applicable to the usual WDA’s.

Who can Claim?

AIA is available to most businesses, regardless of their size. The only business structures that cannot claim are those with mixed partnership (for example, a partnership comprised of both individuals and companies) and Trusts.

What can you claim on?

Most assets purchased for business use qualify including: diggers, tractors, dumpers, lorries, vans, combines, and forklifts. Cars cannot be claimed under this scheme.

Can I claim AIA if I use Hire Purchase (HP)?

Yes – with the intent of ownership you can benefit just the same as buying outright and tax relief is also available on interest charged to the profit and loss account.

If you acquire the use of an asset on a lease agreement where the leasing company has the right to claim capital allowances of the asset (typically an operating lease) then this would not qualify. On the other hand if you are entitled to claim the capital allowances (typically a long term finance lease) then you may be eligible to claim the ASA on the asset. We would suggest speaking with your tax advisor if you are in this situation.

What Differences will the Change in AIA Allowance Mean?

The Long Term positive is that the AIA will be fixed at £200,000 from Jan ’16 which means more businesses can plan for growth and investment, and utilise potential tax relief investing in plant and equipment.

But in the remaining months of 2015, it is important to point out that the clock is ticking if your business can benefit from the potential £500,000 tax relief.

Article originally by JCB Finance Ltd