Sector - Local Government

New report calls for planners to ‘embrace diversity’ to rejuvenate town centres

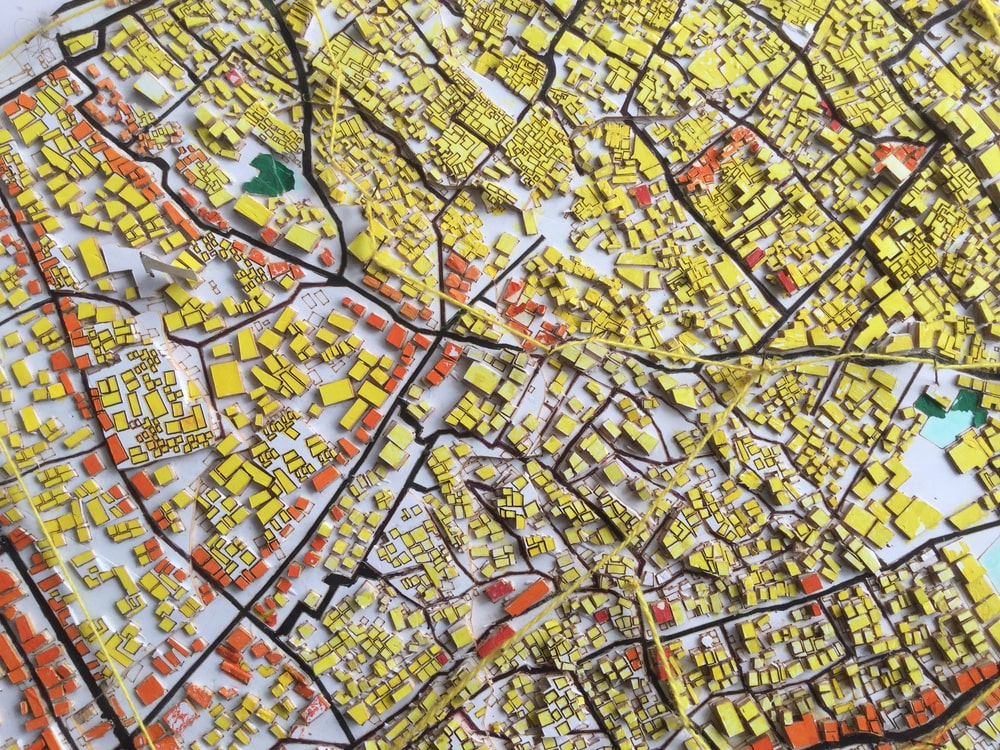

A new research-led report, published by planning and design consultancy, Marrons and national law firm Shakespeare Martineau, is calling for an overhaul in the way local authority planning teams organise and plan for town centre development. Instead of being blinkered by a retail-only mindset, they should ‘embrace diversity’ and adopt masterplanning.

Based on assessment of 360 of the largest towns in England and Wales, the report also includes a new Regeneration Index highlighting where public funding is urgently needed to kick-start town centre regeneration. Each town has been assessed based on housing affordability, job creation potential, population growth and accessibility.

The research confirms that there is a clear North/South divide, with towns in the South East of England more resilient and successful in attracting public and private sector investment than those in the North. Their relative success is largely due to a more diversified townscape, supported by stable population growth and local job creation.

Regeneration Index – the ‘bottom 50’

Only two towns in the South East are ranked among the ‘bottom 50’ (of the Regeneration Index), which means that they urgently need Government support or other public sector investment to kick-start regeneration activity. By contrast, 37 towns in the ‘bottom 50’ are located in in the North of England – including Derby, Spennymoor (Durham), Barnsley (Yorkshire), Selby (Yorkshire), South Shields (Tyne & Wear) and Grimsby. The remaining 21 are located across the rest of England and Wales.

While the ‘bottom 50’ towns have been ranked ‘worst’ in terms of their regeneration readiness, it is hoped that identifying their plight will help to inform future public funding decisions at a local and national level.

Regeneration Index – the’ top 50’

Just six towns in the North of England – which is defined as the Midlands and beyond – and four in Wales, are in the ‘top 50’ (of the Regeneration Index), which means they are among those best placed to grow organically, without requiring urgent Government-backed intervention. The remainder are located primarily in the South of England.

The ‘top 50’ towns have been ranked best in terms of their regeneration readiness, which means they are primed to secure inward investment and grow organically, without the need for urgent Government intervention.

The rankings have been published as the Government faces continued criticism over the allocation methodology behind its £4.8bn Levelling Up Fund, with critics claiming its broad reach is not targeted enough to help areas most in need of regeneration. The application process is also said to be onerous and bureaucratic, costing local authorities significant time and money when applying for funds.

Analysis from the Labour Party has revealed that London will receive a higher allocation of funding (from the Levelling Up Fund) than Yorkshire and the North East, the latter of which will receive almost half of the amount given to local authorities in the South East. Further research by the Institute for Public Policy Research has found that investment in deprived areas of the North of England is amongst the lowest of the world’s most advanced economies.

Calls for ‘masterplanning’

The report calls for an overhaul of the way that local authorities organise and plan for town centre regeneration. A more strategic framework is needed that encourages diversity of use and avoids too much reliance on retail-led solutions.

Adopting a holistic, masterplanning approach will enable planning departments to plan for a whole range of uses – retail, housing, flexible office space, logistics, healthcare, education, heritage reactivation and the innovative reuse of vacant land.

The report identifies an urgent need for planning departments to look for ways to bring community back to town centres with a mix of build-to-rent, later living, student accommodation and co-living projects, to rent and own.

Six policy recommendations

In addition to its calls for a change of planning approach, the report makes six recommendations for policy makers at a local and national level as follows:

- Create a centralised National Brownfield Map – to make it easier for developers and local authorities to identiify opportunities to rejuvenate town centres, both residential and non-residential. This should be supported by a ‘Prove it or Lose it’ policy, where brownfield land is put up for auction if planning consent is not secured within two years of it being advertised.

- Put in place new compulsory purchase order rules that set fixed standards for remuneration and an expedited planning permissions process for town centre regeneration. These rules will help to facilitate public-private partnerships and mitigate the risk of disputes.

- Establish Town Centre Priority Zones that offer incentives to developers and encourage take-up of small-scale opportunities

- Accelerate brownfield development by allowing local planning teams to grant a ‘permission in principle’ designation

- Local authorities to form a Regeneration Panel to help identify and prioritise opportunities; coordinate town centre masterplanning; set out incentives for redevelopment projects and select private sector partners to support project delivery.

Brian Mullin, Head of Marrons, said: “The evidence suggests that our High Streets are suffering and continuing to decline. This critical urban fabric is often most vulnerable to economic turbulence. The decline of physical retail, which has been accelerated due to the pandemic, has compounded the challenge for businesses and communities.

“From a plan-making perspective, retail-or-nothing policy residue in aged development plans is a major contributor to the problem. Acknowledging and embracing the need for more diversity in our High Streets (including specialist and social housing) can offer part-solutions. Attracting inward investment might well involve potential tax incentives or CIL exemptions to address the viability difficulties associated with regeneration; whilst simultaneously creating more robust and vibrant town centre communities, helping to ameliorate our spiralling housing crisis and stimulating economic development to enable recovery and growth.

“Whilst there is no silver bullet for stimulating high street regeneration – there are meaningful and thoughtful changes suggested in our new report which are a step in the right direction.”

Alex Smith, managing director of infrastructure and specialist markets at Shakespeare Martineau, said: “Our Regeneration Index takes a magnifying glass to town-level investment and sets out to explain why some market towns urgently need Government intervention, whereas others are showing that they can support themselves. Previous studies have looked at this problem regionally or have placed a significant emphasis on cities. They have also assumed that funding is limitless. Both of These approaches overlook local disparities that only a granular, town-centre analysis can reveal.

“From the 360 market towns we have analysed, we’ve ranked the 50 most in need of public funding to kickstart regeneration. We’ve also ranked the 50 that are most ‘resilient’, where private sector investment is already evident and more likely to be forthcoming in the future.

“This isn’t determined geographically, but on a range of demographic and social factors, not least employment density, population growth and housing affordability in sustainable communities close to or within town centres.”

The UK Government has committed a total of £9.9bn to be spent over the next five years on town centre regeneration. Commitments include the £1bn Future High Streets Fund, the £2.6bn Towns Fund, the £4.8bn Levelling Up Fund, an estimated £250m in The National Lottery Heritage Fund, and £7.4m from the High Streets Heritage Action Zone scheme.

If you would like to read more stories like this, then please click here

Related Articles

More Local Government News

- Guildford Flood Defence scheme goes on show

22 Jan 26

New proposals have been unveiled for a flood defence scheme to mitigate flood risk in

- Multi-billion pound funding for new devolved regions

6 Jan 26

A long-term investment package of almost £6 billion has been confirmed for six new devolved

- Birmingham City Council Advances £2.5 Billion Ladywood Regeneration Scheme

12 Nov 25

Birmingham City Council has announced a £2.5 billion investment programme for the regeneration of Ladywood.