News - Construction News

Planning application submitted for site at Lymedale Business Park

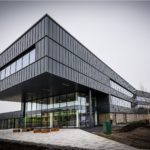

A planning application has been submitted for the delivery of a light industrial scheme at the Lymedale Business Park in Newcastle-Under-Lyme by the investment and development company Cole Waterhouse, as well as their funding partner Peveril Securities.

Going into more detail, the Lymedale Business Park site is expected to create approximately 630 new jobs in the local area with a further 144 construction jobs and 169 supply chain jobs expected to be made throughout the two-year construction process.

In addition to the light industrial site itself, the construction process will entail the improvement of infrastructural networks in the immediate vicinity of Lymedale Business Park, including the establishment of footpaths and cycleways between Loomer Road and Pit Head Close, as well as the landscaping of green spaces on the perimeter.

The architecture company MHA Architects and Lichfields planning consultants were also appointed to the project.

The Chief Executive Officer at Cole Waterhouse, Damian Flood stated: “Our plans will create significant new local employment opportunities and secure a thriving future for the area.

“It is in an excellent location surrounded by existing light industrial buildings, offices and warehouses and we are excited by the potential to breathe new life into a currently unused brownfield site and bring additional and complementary facilities to this thriving employment area.

“The project team has been consulting closely with the Council, key stakeholders and local residents to create an employment-led scheme which will deliver maximum economic benefit to the local area.

“We are really pleased to be moving into this new development sector with this exciting scheme and we will be aiming to secure more industrial and logistics projects as the year progresses. Cole Waterhouse will be focusing on growing its student and high-rise residential portfolio through 2020 and will also look to branch out into care home sector, hotels, strategic land, and asset repositioning opportunities.”

If you would like to read more articles like this then please click here.

Related Articles

More News

- Construction vehicles set for hydrogen-powered revolution

16 Apr 24

Tractors, diggers and forklifts powered by hydrogen will help building sites go greener under government

- Why Modular Construction in the Commercial Sector Stacks Up

15 Apr 24

Richard Hipkiss, Development Director of the MPBA, considers why the outlook in mature commercial markets

- BCIS forecasts building costs to rise 15% in five years

12 Apr 24

Building costs will increase by 15% over the next five years.