Sector - Commercial

Why construction firms are missing out on millions in R&D tax credits

Construction and its partner industries architecture and engineering are hotbeds of innovation with a constant focus on finding more sustainable, efficient and safer ways to build.

More than eight in ten construction, architecture and engineering companies have developed new products, services or business processes in the last two years, according to research from Catax.

This means all these companies could be eligible for valuable research and development (R&D) tax credits, says Mark Tighe who is CEO of specialist tax consultancy Catax.

Yet, more than half of these potentially eligible firms have never made a claim meaning they are missing out on hundreds of thousands that could be reinvested in their businesses.

The average value of an R&D tax relief claim in construction is a massive £105,000 while in engineering it is £62,000 and for architecture it is £42,000.

So, why are so many companies in these sectors failing to claim?

Firstly, because many within construction, architecture and engineering do not realise they are eligible for this tax relief. Many people across all sectors assume that R&D applies only to scientists in white coats playing with test tubes and simply do not associate it with their own work.

But R&D is recognised across multiple sectors and is designed to reward innovation. HMRC defines R&D as work which seeks to resolve a ‘scientific or technological uncertainty’.

This can take the form of a new process, product or service, or simply be an improvement to an existing one. The R&D work does not even have to successful to qualify.

Some of the things that construction firms have successfully claimed R&D tax credits for includes:

- Assisting clients, contractors and design teams in developing new construction techniques and use of materials to suit their design aspirations,

- Providing any testing and calculations required for new construction techniques and materials to satisfy current legislation and ensure they are fit for purpose

- Developing new and job specific methods of installation and safe working procedures to comply with current health and safety regulations

- Development and implementation of 3D design software and modelling systems

- Performing analysis and reviews of proposed structures and finishes to develop suitable techniques to accommodate building movement, thermal requirements and issues, and loadings

- Creating solutions for building on ‘virgin ground’ that has never been built upon before

The second barrier to construction companies claiming R&D tax relief is that they do not know how to go about doing so.

This is understandable as the process of claiming R&D tax credits is complicated. The claim is made up of a calculation of qualifying costs, such as the staff costs and materials you use in the course of the R&D. There are strict rules about what does and does not qualify so without any professional help it is easy to get it wrong.

To ease the process, most companies use a specialist tax consultant to oversee their claims.

Which leads neatly on to the third common reason companies do not claim R&D tax relief – because they fear it will be too expensive and time consuming.

With most reputable tax advisors willing to work on a contingent fee basis, companies do not need to worry about any upfront costs.

If required, these same tax advisors will do most of the leg work for you so there is no need for R&D tax relief claims to soak up your own staff’s time.

Companies working in the construction, architecture and engineering space spent an average of £292,001 on their innovations over the past two years, our research revealed.

This is a major investment so these same companies should start taking a proper look at their tax relief entitlements and make sure they are reaping the full reward of their innovations.

In conclusion, a widespread lack of knowledge about R&D tax credits, who can claim, how and what they are worth is preventing thousands of businesses claiming what is rightfully theirs. For business executives keen to boost their bottom line, this needs to change.

If you would like to read more articles like this then please click here.

Related Articles

More Commercial Features

- A year of procurement, politics and productivity

24 Jan 24

With 2024 shaping up to have a great deal of changes through political, economic and legislative changes, Simon Toplass, group CEO of Pagabo is looking

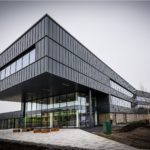

- Constructing to Lidl standards – Is not what you might expect

26 Jun 23

Lidl stores and distribution centres have a focus on whole life cost and added value through sustainable design

- Construction output sees strong rise

8 Jun 23

Construction output has gained momentum amid the strongest rise in new orders since April 2022.