Loss on Ignition Analysis on fines for HMRC requirements

The way landfill tax on waste is calculated has changed with affect from 1st April 2015. HMRC have introduced a ‘Loss on Ignition’ (LOI) testing regime. The aim of HMRC is, ‘helping prevent misdescription of waste fines for landfill tax purposes’, thereby increasing compliance.

The way landfill tax on waste is calculated has changed with affect from 1st April 2015. HMRC have introduced a ‘Loss on Ignition’ (LOI) testing regime. The aim of HMRC is, ‘helping prevent misdescription of waste fines for landfill tax purposes’, thereby increasing compliance.

Download the ALS Environmental HMRC Loss on Ignition datasheet here.

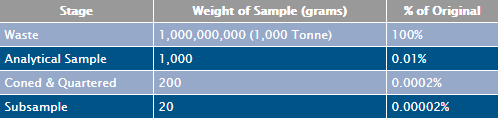

Analysis for LOI involves taking a sub sample of 1kg from a homogenous waste source, this is then dried until at a constant weight, coned and quartered to produce a 200g sub sample. A 200g section of the sample is then sieved to remove all qualifying material over 20mm with recording the weight of any removed material. The remaining sample is ground to <2mm and a minimum of 20g is dried at 180oC until at a constant weight before drying at 440oC until a constant weight is achieved.

Landfill site operators must now test all qualifying fines received from each customer disposing at their sites. This must be done within the time period of which the initial 500 tonnes of waste is delivered to site (or by the 1st May for existing customers / within a month for new customers).

Qualifying fines with an LOI of 10% or below will be eligible for the lower tax rate (£2.65 per tonne) those above will be required to pay the higher tax rate (£82.60 per tonne). During the first 12 months of this regime the threshold will be set at 15%.

The sampling frequency is dependent on the risk factor of the waste: High (Every Load), Medium (Every 500 tonnes), Low (Every 1000 tonnes). This means that a LOI result that breaches the proscribed limit could result in a £82,600 tax bill compared to a £2,650 one.

Christopher Law, ALS Environmental’s Inorganic Chemistry Operations Manager at our Centre of Excellence for waste analysis in Coventry comments:

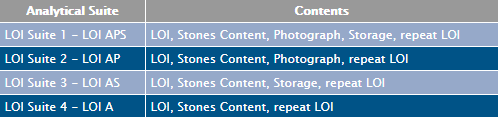

“We have developed a method in line with the HMRC requirements for Loss on Ignition. Working with some of the UK’s leading Waste Management firms has enabled ALS to remain at the forefront of this legislation and provide an analytical service that meets the HRMC requirement, including photography and repeat analysis on samples that fall within the 15.1% to 15.5% limit.”

To help customers meet the HMRC guidance ALS Environmental have developed 4 LOI suites to cover all requirements. From a basic LOI in line with the guidance through to a fully compliant suite that includes storage until the following April and a photograph of the subsample:

If you have any questions on LOI analysis or the additional services that ALS is able to provide to help customers comply with the regulations, including photographs of the sample and storage for up-to 12 months, then please liaise with your Customer Service Co-ordinator or contact on 02476 42 12 13.